Índice

Project funding

A project is referred to a series of planned task that are subjected to accomplishment with the aim to achieve certain output or objective. It is a set of inputs and outputs required to achieve a particular goal. Projects range from simple to complex forms which can be managed by an individual or team. Projects are more specifically described and delegated by projects executive or projects manager.

They work towards their targets and goals and the teams are to manage resources and execute the project in a timely manner. More often, projects are given deadlines or time limitation.

Project loan financing

Project loan financing is a means on how to finance a project and it is regarded as the financing of long-term infrastructure project finance, public projects and industrial services using a non-recourse or limited recourse financial scheme. Project loan finance is a secured lending featured by intricate but balanced project finance risks allocation arrangements.

The project finance risks may include the likes of operational risks, construction risk, political and off-take risks. Project financing is a long-term liability which relies mainly on the project cash flow for its repayment, with project’s assets, rights and interests being other alternatives as collateral. Private sectors find project finance more attractive as companies are capable of financing major projects off-balance sheet.

Project finance Vs corporate finance

As regards project finance versus corporate finance. In a corporate or traditional finance, the company executing the project which is also known as sponsoring company mainly acquire capital or fund by presenting its available assets on its balance sheet to lenders which serve as guarantee (collateral) for the repayment of the loan if its unable to procure enough funds to repay the loan acquired. Hence the lender will repose on such company’s assets, convert them to cash and recover its investment.

While in project finance, debts repayments are not based on the sponsoring company’s assets, instead it is repaid using the revenue that the project to be executed will generate on its completion. Sponsoring companies must always consider some factors before choosing either of corporate or project finance structure which includes risks involved, amount of capital needed etc. project finance largely reduces risk for sponsoring company because the lender only rest on the revenue generated to repay the loan and there is no cause for chasing the sponsoring company’s asset in the case of default.

Project for bank loan

Banks gathers capitals from the interest and at later time forfeit interest based on calculated rate on some accounts. These capitals are granted to the sponsoring company (borrower) and receive interest on the loan in return. Their ability to collect deposits from several sources that can be offered to borrowers provides help in generating the capital flow that form an intrinsic part of the banking system or mode of operation. Through monitoring and controlling their capital instream, banks increases revenue, basically by acting an agent role and considering the risks of providing finance to borrowers.

Construction project finance

Project construction finance also known as self-build loan is referred to as a short-term loan which is used to sponsor or finance a home construction or any other form of real estate project. Construction project finance is taken to be fair in risk but normally has higher interest rate compared to mortgage loans or finance.

Real estate project finance

This is a classic example of project finance. Project finance is a long-term financing of a stand alone or independent capital investment. They are projects that have both cash flow that can be noticeably isolated.

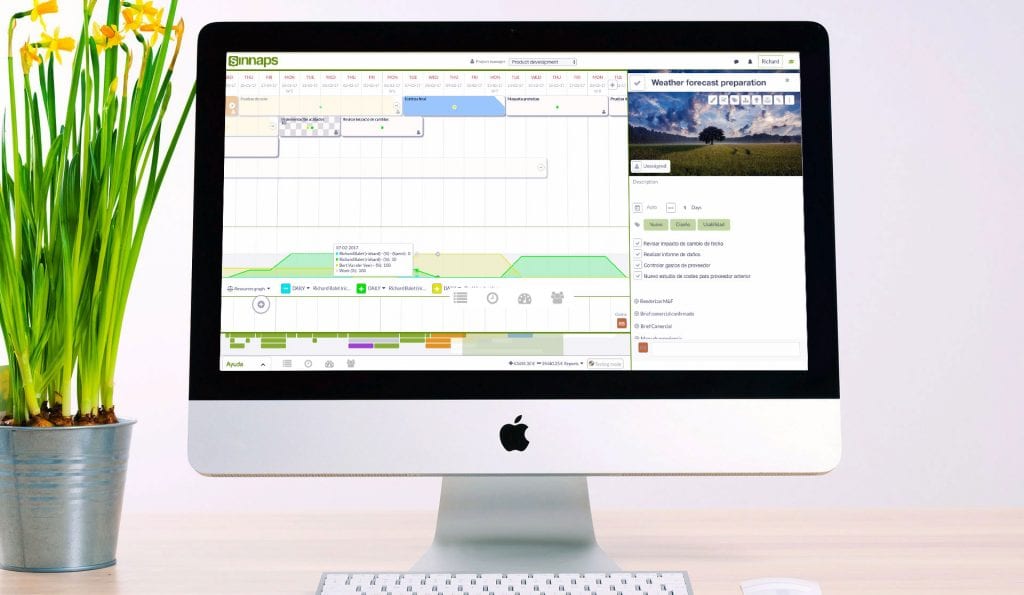

One of the real estate project finance tips is to keep track of your resources. Sinnaps allows you to effectively manage your resources.

How to Manage Resources in 3 minutes

Related links…

Free Project Management Templates

Project Finance Model and Methods

The project finance models and analysis are basically the task or job of constructing an abstract design (a model) of real-world scenario as concerned the project financing situation. This is typically designed in a mathematical model to represent simplified edition of financial performance of a business portfolio, or project.

Also, project finance method or modeling is known to represent an exercise, which may be asset pricing or corporate finance which is quantitative in nature. It is the mathematical forecast of sets of hypotheses about reaction or behavior of agents or markets. Project finance method is a term that varies in meaning to different people or users. Its reference normally relates either to applying for corporate finance and accounting or to quantitative finance applications.

The tasks of financial modeling have over the years captured embracement and rigor. The quantitative financial modeling or method comprises of developed complex mathematical model which deals with asset prices, markets changes, portfolio returns et cetera.

A project planning app such as Sinnaps can help you to create, track and manage important business documents.