No doubt, the major challenges bedeviling the growth of small and medium enterprises are risks. The inability of SME businesses to effectively manage risk is the clog on the wheel of their progress; lack of proper management of risk is the major reason behind the failure of small and medium enterprises.

In reality, risk comes in the form of changing market conditions, lack of capital and poor business conditions which could pose a threat to the growth of small and medium enterprises.

In fact, many small and medium businesses have run into difficulty because of lack of proper risk management strategies to effectively overcome the challenges of risks. In reality, as a manager of small and medium enterprises, you can never shy away from risks; it is the reality your business must contend with.

Small and medium enterprises risk management helps you in developing strategies to identify, evaluate, and prioritize risk. It helps in the coordination and application of resources to minimize, monitor, and track the impact of risks in order to maximize the opportunities of your business.

SME risk management is the ideal tool that you can effectively leverage to nurture the growth of your business organization in order to fulfill your goals and objectives.

The nature of the tools used in managing risks plays an important role in the success of small and medium enterprises risk management strategies.

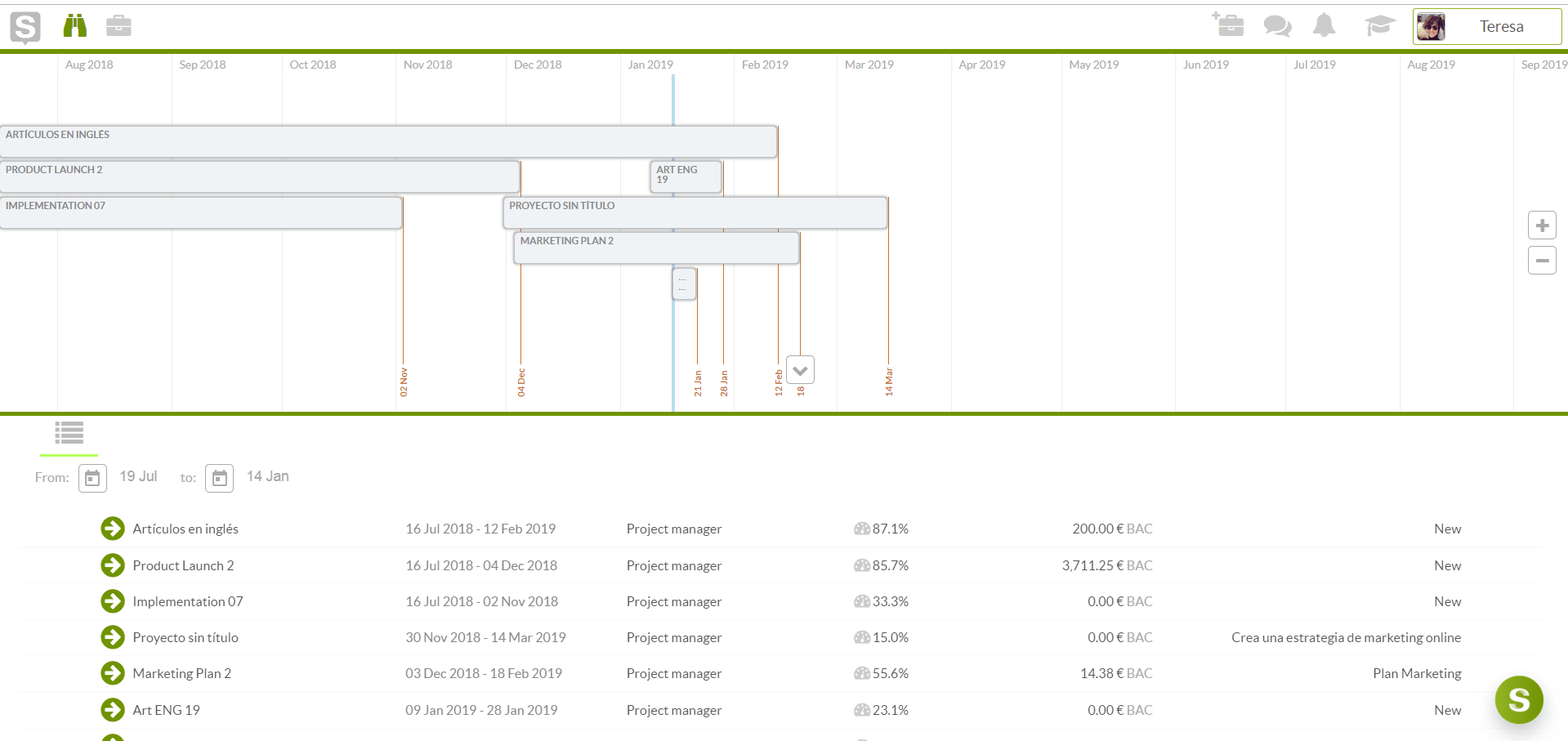

Sinnaps, an online project management tool that you can use to develop small and medium risk management strategies to mitigate the impact of risks on your business. It will help you in strategic planning to manage your business risks and maximize your resources to achieve the desired results from your agile risk management efforts.

As a tool, it will ensure effective management of your resources so as to achieve the desired results by displaying how your resources are being used on the graph. Also, it will determine the critical path of your activities thereby aiding you in meeting the deadlines of your assignment.

Related links…

Network Diagram in Project Management

SME Risk Management

Without mincing words, the contributions of small and medium enterprises cannot be underestimated because large business corporations existing today started small but they were able to achieve growth with effective management of risks involved in their business activities and they are always committing huge amount of resources to it.

Create simulations in the Test Mode

Small and medium risk management is the secret you can use to grow your business organization. Some of the risks most SME managers face range from uncertainty in financial markets, threats from project failures, legal liabilities, credit risk, accidents, and natural disasters.

The task of overcoming these challenges requires having SME risk management strategies in place to confront them. SME risk management involves the use of strategies to manage threats by avoiding the threats, reducing the negative effect of the threat on your business,  transferring all or part of the threat to another party or the retention of some or all of the potential of the threat.

transferring all or part of the threat to another party or the retention of some or all of the potential of the threat.

SME risk management allows you to manage the threats that your business is exposed to by handling and prioritizing the risk that could have the greatest negative consequences and greatest probability on your business and then followed by the risks with lower probability and lower negative impact.

With SME risk management, you will be able to strike a balance between risks with a high probability of occurrence but lower loss and risks with high loss but lower probability and allocate the resources to manage them effectively.

The strategies of SME risk management include the following:

- Identification of the threats that could pose risks to your business activities

- Access the vulnerability of critical assets to particular threats

- Determination of the risk: here, you are required to carefully examine the likelihood and consequences of the particular types of attack on the specific assets of your SME.

- Identify how to reduce the risks

- Prioritization of the risk reduction measures

See Your Project Resources In The Resource Graph

![]()

Risk Management Structure

Risk management structure enables you to have alternative risk management in your organization. It affords you of the opportunity to carefully evaluate all the risks that business organization faces by risk category and properly manages the risks in accordance with the strength of your organization thereby enhancing effective management that will assist you in achieving the desired results.

Risk management structure improves your ability to manage risk through comprehensive deliberations among the management team. It allows the management to regularly receive reports on the status of risk management, monitor their risk management performance and make the crucial decisions on the important issues regarding the organization’s risk management strides.

With risk management structure, you can handle the following effectively:

Credit risk management: risk management structure enables you to manage the risk related to the credit provided to individuals.

Market risk management: with a risk management structure, you can effectively carry out market risk management by ensuring a check and balance system for the operations of the business by developing risk management systems that are independent to ensure that risks are well managed without exceeding the maximum level.

Liquid risk management: it allows you to create the systems that will respond to the actual cash flow solution of small and medium enterprises.

Risk Management Overview

Risk management overview is the process that allows you as a business manager to be anticipatory in terms of managing the risks that your SME is exposed to and be able to put measures to overcome them.

Risk management overview focuses on the understanding of the major risks of your organization and managing them to an acceptable level. It allows collaborative approach where risk response plans are designed with the relevant stakeholders who have an in-depth understanding of the risks and can manage them effectively.

Risk Management Overview:

The Overview of your Project Portfolio

Risk management overview identifies the risk, prioritizes risk based on the likelihood of occurrence and impact they could have on business, implement strategies to mitigate risk and monitor the effectiveness of risk management efforts.

Also, risk management overview allows you to embrace risk management trends in the management of risks. Risk management trends will enable you to know that the business environment is very complex and volatile with each passing day.

Risk management trends will allow you to know how you can proactively safeguard your business against threats and risks to ensure that your business is prosperous.

With risk management trends, you will be in the know that risk management is constantly changing, the need for you to realize the value of inculcating a strong risk management practice, the need for emergence of collective risk management, integration of risk management into other business processes and understand why risk management is the key to effective business performance.

Furthermore, risk management overview has assisted SME in having transportation risk management plans by combating the threats they face in their organization regarding transportation issue such as cyber-attacks on physical assets, advancing technology, continuous shortage of drivers, and deteriorating infrastructure, greater regulatory oversight, and demand volatility.

The task of managing the risk of SME can be simplified with risk management monthly, it allows you to plan ahead and be quick in responding to risk matters of your organization and also helps in reporting the risk management activities.

Cloud risk management enables you to have a strategy that will result in effective management that boosts operational effectiveness and enhances customer satisfaction by driving business growth through enhanced collaboration.

It is imperative for SME to integrate product risk management in their risk management activities to identify, treat, control and monitor risk as part of product development. Product risk management is done to know if the product will meet the expectation of the customers.

With Sinnaps, you have a tool that will assist you in product risk management through effective planning. It will ensure that you come with strategies that manage and track the risk of your product to achieve the satisfaction of your customers.

Related links…